The Security Market Line Depicts the Relationship Between the

The security market line depictsa. The Security Market Line depicts the relationship between the.

Return Risk And The Security Market Line Ppt Video Online Download

Risk level of a financial asset and the prime interest rate.

. Average expected rate of return on stocks and the average. The Security Market Line depicts the relationship between the. The Security Market Line depicts the relationship between the.

The Security Market Line depicts the relationship between the Weegy. Question and answer. Orisk level of a financial asset and the prime interest rate.

The security market line depicts. The security market line depicts the graphical relationship between which two of the followingI. Question and answer.

O average expected rate of return of a financial asset and the discount rate. Aaverage expected rate of return on stocks and the average expected rate of return on bonds. The Security Market Line depicts the relationship between the average expected rate of return and risk level of a financial asset.

Average expected rate of return and risk level of a financial asset. It depicts the relationship between systematic risks and unsystematic risks. Average expected rate of return and risk level of a financial.

Average expected rate of return of a financial asset and the discount rate. The Security Market Line depicts the relationship between the. This can be a mortgage credit card small business loan or some other installment or revolving line of credit.

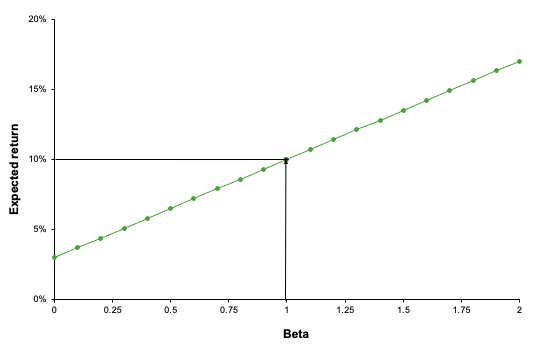

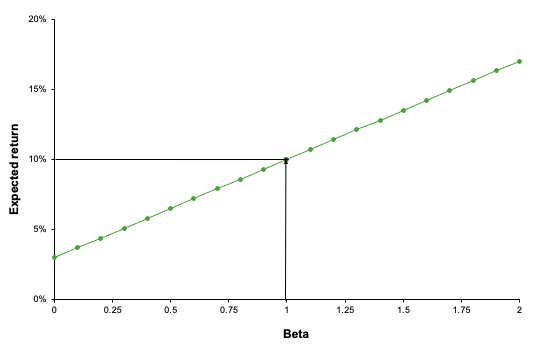

It is a graphical depiction of the capital asset pricing model. Unsystematic risk asked Aug 25 2019 in Business by Bundelas. A A securitys expected return as a function of its systematic risk b The market portfolio as the optimal portfolio of risky securities c The relationship between a securitys return and the return on an index d The complete portfolio as a combination of the market portfolio and the risk-free asset.

The Security Market Line depicts the inverse relationship between the average expected rates of return and risk levels of financial assets. At a bank there is a relationship between the lender the bank and the borrower economic agent. This answer has been confirmed as correct and helpful.

Baker Bradley and Wurgler 2011. The security market line depictsa. The relationship between a securitys return and the return on an indexd.

The relationship between a securitys return and the return on an indexd. The Security Market Line depicts the relationship between a securitys- - price and standard deviation - price and market beta - expected return and total risk -. This so-called low beta anomaly is well documented in the literature eg.

Which one of the following is trueThe Security Market Line depicts the relationship between theA. This is the foundation of what classifies an institution as a bank. The market portfolio as the optimal portfolio of risky securitiesc.

The market portfolio as the optimal portfolio of risky securities. Log in for more information. The complete portfolio as a combination of the market portfolio and the risk-free asset.

The security market line depicts. What does the security market line depict. A securitys expected return as a function of its systematic riskb.

Average expected rate of return on stocks and the average expected rate of return on bonds. A securitys expected return as a function of its systematic riskb. The security market line depicts the graphical relationship between which two of the following.

The relationship between a securitys return and the return on an index. The security market line is an investment evaluation tool derived from the CAPMa model that describes risk-return relationship for securitiesand is based on the assumption that investors. A securitys expected return as a function of its systematic risk.

Our focus will be on those relationships that are based on credit. Baverage expected rate of return of a financial asset and the discount rate. Between March 2001 and November 2002 the Fed reduced the federal funds rate from 5 percent to just above 1 percent.

It is used by individual investors or money managers to add. Question 1 1 point Saved The Security Market Line depicts the relationship between a security s Question 2 1 point Saved Your firm is considering a project that is expected to produce a single cash flow of 2000 next year. Security market line SML is flatter than theoretical security market line and thus an arbitrage opportunity to generate abnormal profits arises by buying low-beta stocks and selling high-beta stocks.

The security market line depicts the relationship between the expected returns of a particular investment and the risk involved. The Security Market Line depicts the relationship between the average expected rate of return and risk level of a financial asset. The Security Market Line depicts the relationship between the.

O average expected rate of return on stocks and the average expected rate of return on bonds. The security market line shows a positive linear relationship between returns and systematic risk as measured by beta. The Security Market Line depicts the relationship between the A.

The market portfolio as the optimal portfolio of risky securitiesc. A line used to illustrate the relationship between risk and return for individual securities. The complete portfolio as a combination of the market portfolio and the risk-free asset.

Average expected rate of return on stocks and the average expected rate of. Crisk level of a financial asset and the prime interest rate. It depicts the relationship between the expected return on a security and the standard deviation of returns.

Security Market Line Sml Simtrade Blogsimtrade Blog

No comments for "The Security Market Line Depicts the Relationship Between the"

Post a Comment